Jaiprakash Power Ventures Limited (JP Power) has become one of India’s largest players in the power sector whose business entities are engaged in power generation in hydro and thermal based power plants. Investors investing in the Indian market will likely screen what JP Power’s future stock price maybe? India’s insatiable energy appetite is going to see the Juggernaut continue.

This article projects the share price targets of JP Power until 2030, taking into account several factors that might affect its performance in the stock market.

Overview of Jaiprakash Power Ventures Limited

Established in 1994, JP Power is the power unit of Jaiprakash Group, which has interests in construction and cement among others. It has a number of power plants that serves to meet the electricity demand of one of the largest populated countries in the world. With an emphasis on sustainable energy solutions, JP Power is set to benefit from the burgeoning power demand.

Key Financial Metrics

It is crucial to have a look at JP Power’s financial condition since we have to check if the company is in good financial health. Here are some key metrics:

- Market Capitalisation: ~ ₹ 12,932 crores as of 30 June 2024.

- P/E Ratio: 12.72 This number lets you know how well the company is doing in relation to its stock price.

- Debt to Equity Ratio: 0.37, A lower number indicates lower financial leverage.

- Return on Equity (ROE): 12.20%, indicating how the companys profits compare to the value of shareholders equity.

These ratios offer a brief glimpse of JP Powers’s financial position and growth potential to invest in, but should be backed by further research.

Performance History of JP Power

We can gain some insight by looking to the past performance of JP Power. The company has posted solid top and XGrowth for the last five years. The stock price has also had considerable appreciation.# The share price have already been a significant appreciation, which shows the believe in the companys operational strategies.

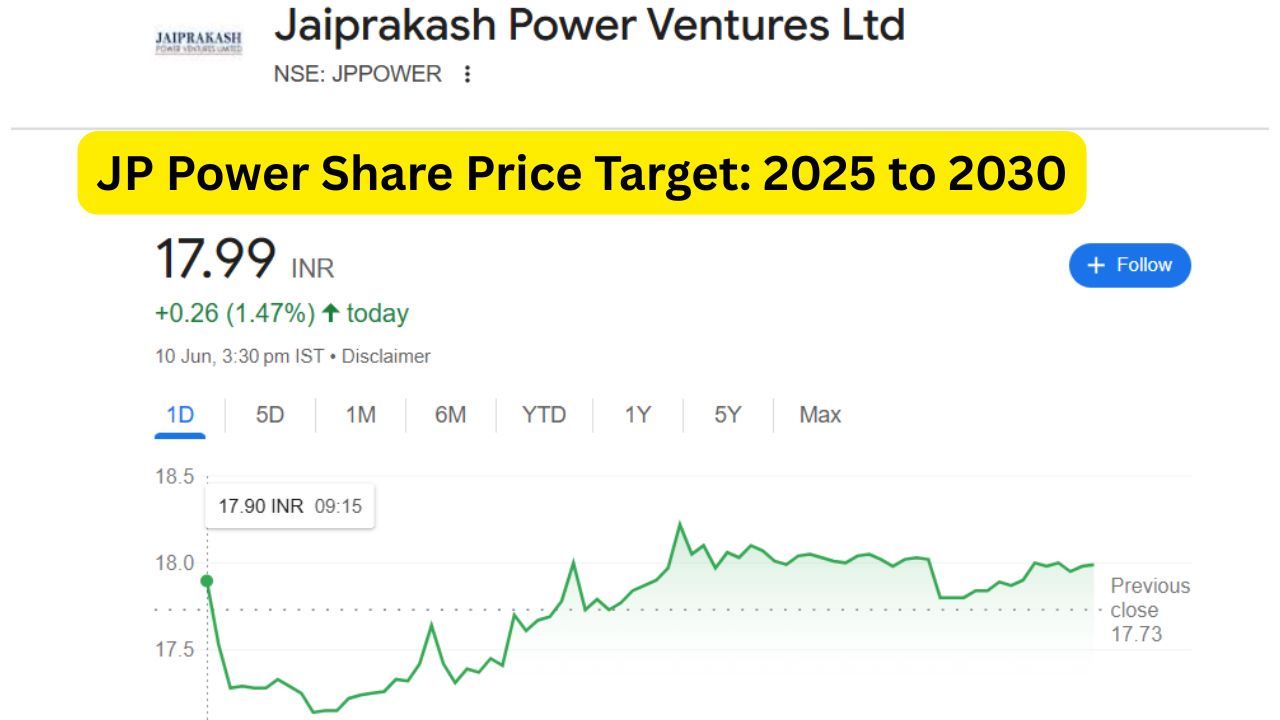

Share Price Trends

- 52-Week High: ₹24.00

- 52-Week Low: ₹14.35

- Current Price: Around ₹17.99

The day’s stock price choppiness accords with the volatility that’s more commonly observed across the energy sector as a whole, subject as it is to all sorts of market dynamics and dictates (to which add periodic regulatory upheaval).

Factors Affecting JP Powers Share Price

There are few variables which can determine the future price movement of JP Power. It is important to know these concepts so that you can make informed investment decisions.

Demand for Energy

India’s growing need for electricity, which it needs to fuel its urban growth and industrial expansion, offers JP Power a huge opportunity. The company’s capability to increase from its current power generation capacity is central to satisfy this demand.

Government Policies

Then there is the Indian governments emphasis on renewable energy and sustainability. The JP Power’s of the world, which are trying to diversify their energy portfolio would benefit from such announcement to promote the renewable energy companies.

Market Competition

The competitive conditions in the energy industry could also affect JP Powers’ market position. The company has to fight other industry players while also capitalizing on its strengths in thermal and hydroelectric power.

The share price target of JP Power for 2025

As we move forward, trends indicate that, share price for JP Power by 2025 is projected at different expectations by brokering firms, according to its current growth path.

Price Projections

- Minimum Target: ₹18.00

- Maximum Target: ₹22.00

These estimates are a result of the expected operational efficiencies of the company in addition to the growth dynamics of the energy sector in India. And should JP Power’s strategy work, then it may see its share price attain these targets.

Monthly Breakdown for 2025

| Month | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| January | 17.50 | 20.00 |

| February | 18.00 | 21.00 |

| March | 18.50 | 21.50 |

| April | 19.00 | 22.00 |

| May | 18.50 | 21.00 |

| June | 18.00 | 20.50 |

| July | 19.00 | 21.50 |

| August | 19.50 | 22.00 |

| September | 20.00 | 22.50 |

| October | 20.50 | 23.00 |

| November | 21.00 | 23.50 |

| December | 22.00 | 24.00 |

JP Power Share Price Target for 2026

Even further out, the 2026 price target indicates Lidar will both continue to grow and adapt as the energy world changes.

Price Projections

- Minimum Target: ₹26.00

- Maximum Target: ₹30.00

These goals were evolved off JP Powers strategic initiatives and the expected growth in renewable energy space. Adaptation to market changes by the company will be key in realizing those forecasts.

Factors Driving Growth in 2026

Growth of Alternative Energy Projects: J P Power’s focus on increasing the Share of renewable power in it’s total generation mix will further improve its market standing.

Government Support: Further government support for renewable energy projects could create an environment conducive to growth.

JP Power Share Price Target for 2027

By 2027, the share price targets for JP Power are anticipated to represent the company’s continued growth.

Price Projections

- Minimum Target: ₹34.00

- Maximum Target: ₹39.00

These estimates are based on the firms level of operational efficiency and a growing costumer interest in renewable power solutions.

Key Drivers for 2027

- Technological Developments: Advances in technology in power generation can help JP Power to increase its operational efficiency.

- Market Demand: Increase in energy consumption in India that will fuel the company’s growth going forward.

JP Power Share Price Target for 2028

By 2028, JP Power should gain an even stronger footprint in its industry, with share prices also reflecting its growth.

Price Projections

- Minimum Target: ₹45.00

- Maximum Target: ₹50.00

These targets reflect not just company strategy, but also the market’s long-term trends toward renewable energy.

Growth Opportunities in 2028

Greater Load: Expansion and new projects at power plants will drive up revenue.

Sustainability Initiatives: The emphasis JP Power’s place on sustainability will speak to investors and customers.

JP Power Stock Price Target for 2029

Looking ahead to 2029 and the JP Power share price targets, it also represents considerable growth from where the company is today as JJ Power continue to drive profitability in the energy market place.

Price Projections

- Minimum Target: ₹60.00

- Maximum Target: ₹65.00

The forward-looking statements are based on the companys current expectations and what the company believes are reasonable assumptions; however, the company options expected future performance, anticipated market growth, plans for future investments, and other forward-looking statements.

Factors Influencing Growth in 2029

Regulatory backing: Positive government policies would further improve the operational prospects of the company.

Market Positioning: Strategy positioning in the energy industry will be a key to the growth of JP Power.

JP Power Share Price Target for 2030

JP Powers target price estimates for the 2030 will be in line with long-term growth prospects.

Price Projections

- Minimum Target: ₹70.00

- Maximum Target: ₹80.00

Such targets reflect the Companys strategic objectives like the general market environment, which appreciates renewable energies.

Long-Term Growth Drivers

- Sustainable Energy Focus: JJPs dedication to sustainability is sure to be well-received by both investors and consumers.

- Technological Development: Further improvement of the power generation technology will improve upon per unit operation of power.

Conclusion

To sum up, JP Power Ventures Limited seems to be poised for topline and bottom line expansion in future and valuations according to share price targets are at discounted rates in comparison to strategic initiatives being taken and changing dynamics of energy space.

With increasing need for power in India, the companys emphasis on eco-friendly power solutions is the key for its growth. As an investment, investors need to closely watch the companys performance and market trend to decide on their exposure in JP Power.